This seventh area of Total Wellness, financial wellness, is one of the most misunderstood. This post won’t have tips for spending less, saving more, budgeting better, or investing smarter. Because financial wellness isn’t about how much money you have or even if you have “enough,” it’s about your relationship with and attitude toward money.

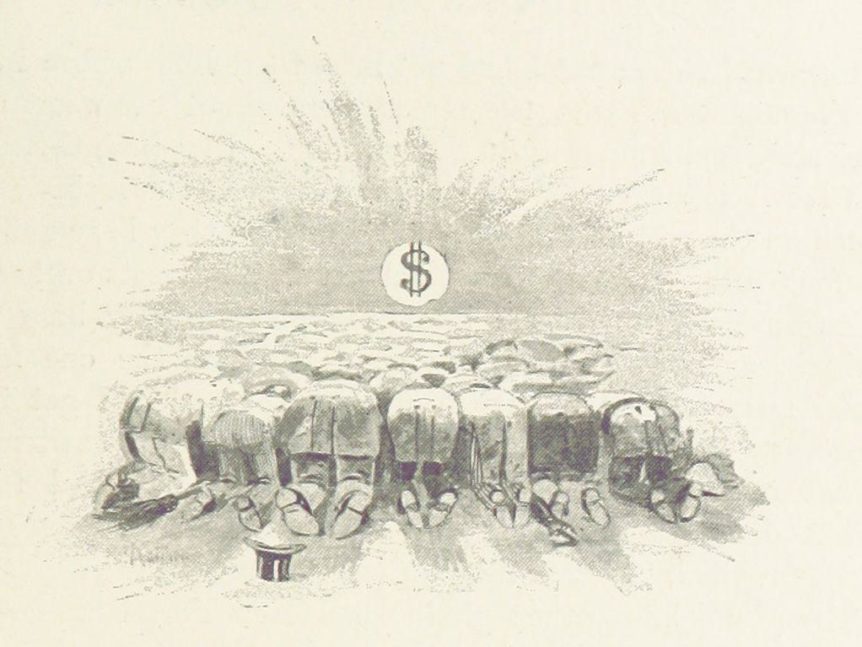

I trust you have heard the saying, “money is the root of all evil.” But that’s actually taken out of context. The full Bible verse (1 Timothy 6:10) reads, “the love of money is the root of all evil.” I would suggest that the abbreviation is just one more effort on our part to project the blame for our own unhealthy decision making onto something or someone else rather than taking the responsibility ourselves.

Money itself is not the problem. In fact, the very same dynamics can operate even in the absence of money! When I was working as a counselor at a state correctional institution where money was contraband, I witnessed residents using valued commodities such as soap and cigarettes as a form of currency. Although these items were not worth much money, within the prison they were far more valuable than their sticker price. They represented power, dominance, and even respect—all of which were priceless “possessions” in the prison system!

Photo by: Jon Tyson on Unsplash.com

It isn’t money (which is neither good nor bad), but the meanings and significance we assign to it that can be harmful. When money becomes our source of worth, our primary identity, or our “god,” it has taken on an outsized role, which can lead to devastating results.

Last year I had an opportunity to speak with the granddaughter of a major business owner who committed suicide following the stock market crash of 1929. She became very emotional as she shared her family’s story. She took out her cell phone and read me the exact words from her grandfather’s suicide note:

“I am embarrassed and sorry that I have lost the financial security I had promised all of you.”

She looked up and said, “He was so caught up in his money that he didn’t realize that by taking his own life he robbed his entire family of his presence in our lives. I never got to know him.” Consider that for a moment. This act many years before her birth impacted her so deeply that she kept a copy on her cell phone!

Her grandfather’s belief is not uncommon. Money is often seen security. Most of us have been struggling with various forms and levels of insecurity most of our lives, consciously or unconsciously. To deal with this insecurity, we might seek out like-minded people who bolster our confidence in our particular worldview or choose to follow a religious tradition with clear rules and “inerrant” theology, thus providing us with a false sense of control and security. Accumulating money is yet another way of dealing with our internal insecurity.

I know this has certainly been true for me! Like many people who have come out of family systems with very limited financial resources, I grew up with a high degree of anxiety surrounding money. I knew a lack of money could restrict opportunities and choices, and even my very survival! As I mentioned in my last post, it was my fear of ending up as a coalminer like my father that spurred me to seek higher education and better job prospects.

The association of money and security is not entirely unfounded. To a certain degree, money does, in fact, grant security. As an educated professional, I had many more options than my father and much greater protection from misfortune. I didn’t have to worry that an injury or mine closing could end my career at any time or a simple home repair would overstretch our budget.

The association of money and security is not entirely unfounded. To a certain degree, money does, in fact, grant security. As an educated professional, I had many more options than my father and much greater protection from misfortune. I didn’t have to worry that an injury or mine closing could end my career at any time or a simple home repair would overstretch our budget.

However, these very real benefits got mixed in with beliefs that are not grounded in reality. Although I obviously have come to believe that money is not the root of all evil, it is also not the ultimate source of security. However, like many if not most of us, I have also “bought” into that dangerous and insidious deception on some level.

Sorting through what is real and what is a reaction to my early life journey has been a lifelong struggle. Many years ago, I realized I saw money, not only as a path to greater external security, but also as a way to ease the internal insecurities I felt. Growing up in modest circumstances, from a small, rural town, I often felt insecure and “less than” others even as an adult. The status money confers, both to others and to ourselves, helped—temporarily and superficially, at least—ease those feelings.

I had to embark on an intentional journey to dismantle those dangerous beliefs and begin to honestly wrestle with my insecurities before I could explore what could provide me with true internal security. Growth in both the spiritual and relational areas of wellness have been critical in gradually shifting my sense of security to those things that really offer it.

I found that the more inwardly secure I got, the less judgmental and less critical I became of folks who act, think, worship, and look different than me. This growing comfort level allowed me to become more open to listening and attempting to understand how and why others folks see, act, and believe differently. The more I learned, the less afraid I was. As my internal security continued to grow, the more I was freed up from the deadly grip of money and believing it is our primary source of security.

Photo By: David Suarez on Unsplash.com

Although I’ve certainly made significant progress, insecurity continues to be something I wrestle with. It is often a case of “two steps forward and one step back!”

While I don’t struggle so much with wanting to buy “stuff” to compensate for my insecurity, I continue to grapple with the fear that we may not have the financial resources we will need to support ourselves as we age and face the unknown. Based on the messages I received in childhood, this fear still exerts more power over me and some of my financial decisions than I would like. Luckily, I strongly believe it is the direction we are moving that excites our Creator, not necessarily where we are on the journey!

Another common way in which money can be misused that I’ve observed with both friends and counseling patients is using buying things as a form of self-medicating or self-rewarding. In some cases it has become an addiction leading to extreme hoarding! This behavior has exploded during Covid and with the ease of buying and delivery without leaving our homes.

I have had patients struggling with depression who had rooms overflowing with packages—often unopened! Sometimes their overspending was so excessive it became a financial crisis, but even in people who could “afford” it, it was problematic because it didn’t address the real issue. Trying to solve emotional problems with material solutions never works, and often just creates a new set of problems!

A final area of financial wellness that I’d like to address is where it intersects with relational wellness. Money can really damage relationships. Everyone knows how dangerous it is to mix business and friendship, and depending on which study you read, money is either the #1 or #2 (second to infidelity) reason couples divorce. And of course conflict over money often makes the divorce even more vicious and destructive.

Inheritances are another thing that can rip families apart. More often than not, it isn’t just the inheritance itself, but the emotional meaning behind it—hot-button issues like love, fairness, and favoritism—that makes these conflicts so bitter.

I recently heard from an old friend with quite a story to tell. Todd’s father had been a very successful business owner and had substantial wealth. After his retirement, he and his wife had become involved with a school in Sudan through a childhood friend who became a Franciscan Brother. They were so moved by both the mission and the children that they decided to not only fund the completion of the school and all the supplies needed, but building a second school as well!

Todd and his wife were elated by the joy and peace this decision brought his parents but his three siblings were quite upset and angry with the parents for depleting their inheritance. His parents were in the process of rewriting their will to include the schools when Todd’s father had a massive heart attack and died instantly during the night. His parents had been childhood sweethearts and his mother died within two weeks of a “broken heart”!

In the mist of their overwhelming grief, the family was informed by the parents’ attorney that the new will wasn’t quite finished and therefore it wasn’t signed. However, he had all the details of what the parents wanted if the siblings wanted to follow their wishes. Even though all of the children would still be well off in the new will, the other three siblings got their own attorney who quickly notified the family that the original will would have to be followed since the one being worked on wasn’t ever signed.

Todd tried to convince his siblings to go with what they all knew their parents wanted but all three refused to consider Todd’s proposal and consequently the estate was divided equally between the four children. Although this could easily have caused a permanent falling-out, Todd knew this would have caused his parents even more pain than their will not being honored.

Instead, Todd and his wife quietly decided to set their inheritance aside until they could discern what their God wanted them to do with it. Eventually they became involved in helping low-income students get a higher education and set up a foundation in his parents’ name. There were several requirements such as each student had to obtain a part-time job to help with their expenses. They were also expected to begin paying back into the foundation to support other students. Both of the original recipients have been successful in breaking through the poverty cycle and have been contributing financially to the foundation. The number of students benefiting from the foundation has been growing every year!

Todd explained that this experience has totally transformed their understanding of money and in his words, “it helped us put a healthy perspective on money which has affected our entire life journey!” But even better, they didn’t alienate his siblings in the process. In fact, one of his sisters recently visited the foundation and was so moved that she sent a check that blew them out of the water. “It was so huge,” Todd said, “I had to keep looking at it over and over again to believe it was real!”

Money can be a crutch, an addiction, a divider, and even a false god. But it can also be a tool for amazing life-changing transformation—it all depends on how you use it!

QUESTIONS FOR DEEPENING THE SPIRITUAL JOURNEY

- What childhood messages about money were you raised with? Are you still carrying them around? Are they helping or hindering you?

- Do you feel you have money in its proper place in your life? What emotional meanings does it hold for you? Does it represent security, freedom, status, power, identity, love, or something else? Are these meanings warranted?

- How has money affected your relationships, both negatively or positively? How could changing your relationship with money improve your relationships?

- Do you ever use material things to try to solve emotional problems? What has been the result?

- Do you ever judge other people based on their wealth or material things? (This could mean making negative judgments about people with “too much” money as well as looking down on people with limited means!) How does this limit you?

- What is the basis of your inner security? Is this a stable foundation? Are there other places that might provide greater security and enduring, everlasting well-being?

- How do you currently use your financial resources? Are you happy with the impact you are making? How could you get more fulfillment from the way you use your resources?

Terry,

That was a good thought-provoking message, and the questions challenge me to reach back in time to look at how money has shaped who I was and am now. Thank you.

Terry thanks for another inciteful article. As a child of 2 depression-era parents. I grew up in my grandparents’ home. My grandparents lost the family farm during the Depression, I was filled with stories of the Great Depression and it is not hard to see, even now, how it effects me. Thanks for letting me know I am not alone.

Terry, Great blog. Besides the wonderful insights, I appreciate your two references to coal mining being a coal cracker myself.

Tom

I never thought I had a money problem because I had prioritized my life around the security money provided. I had enough money but it had never been enough. Your story about the man thinking he had let everyone down and his granddaughter just wanted him in her life. It’s a message I’ve heard before that many times as parents we think we need to be the hero’s of the family bringing home the bacon but what our family really wants is our presence. What a blind spot for me. It is a very tough thing to unravel but I… Read more »

[…] from the fact that they are two primary foundations of my sense of security in this world. In the post on Financial Wellness, I described how accumulating money can be an (ineffective) attempt to deal with our own internal […]